In a move marking a historic shift in global reserve asset strategies, the Saudi Central Bank has revealed its first indirect exposure to Bitcoin through a stake in Strategy (formerly MicroStrategy), the world’s largest corporate holder of the cryptocurrency. The May 16 filing with the U.S. Securities and Exchange Commission confirms ownership of 25,656 shares in Strategy, which currently holds 568,840 BTC — an estimated $60 billion worth of digital assets.

This strategic investment, while not a direct Bitcoin purchase, suggests the Kingdom is testing the waters of digital currency amid growing global trends of decentralization and diversification. With no official recognition of crypto within its borders, Saudi Arabia’s indirect entry into the market reflects both caution and ambition, aligning with the country’s broader modernization efforts under Vision 2030.

In this article, we explore the Saudi Central Bank’s stake in Strategy, examine its implications for national reserve policies, analyze how the Kingdom is positioning itself in the MENA crypto landscape, and review what this move signals about the future of state-level Bitcoin exposure.

$11 TRILLION BLACKROCK SAYS CENTRAL BANKS ARE LOOKING TO BUY #BITCOIN

IT’S HAPPENING!!! pic.twitter.com/YNbZaD5EBA

— Vivek⚡️ (@Vivek4real_) May 4, 2025

Strategy Stake Unlocks Indirect Bitcoin Exposure

Saudi Arabia’s entry into the Bitcoin economy came not through buying BTC directly, but by investing in the stock of Strategy, a firm known for turning its corporate treasury into a Bitcoin vault. With 25,656 shares in Strategy, the Saudi Central Bank gains exposure to a company that now controls 568,840 BTC — the most of any public entity globally. Based on current valuations, this puts the Kingdom’s indirect exposure near $60 billion.

What makes this move unusual is the contrast it presents to the conservative financial approach historically favored by Gulf central banks. Traditionally, oil-rich nations such as Saudi Arabia have leaned heavily on U.S. dollars and gold to back their reserves. But the Strategy investment signals a notable exception, allowing Saudi Arabia to tap into Bitcoin’s long-term appreciation potential without holding or managing the volatile asset directly.

A Tested Model for Risk-Aware Governments

Saudi Arabia appears to be emulating the approach used by Norway’s Government Pension Fund Global, which gained crypto market access through equity investments in Coinbase and Strategy. This method offers a way to participate in digital asset growth while maintaining distance from custody risks, trading volatility, and regulatory gray zones. With Bitcoin still classified as speculative in many jurisdictions, this hybrid model satisfies risk committees while positioning countries for upside.

But the move raises questions. Will indirect exposure evolve into direct holding? Will other Gulf Cooperation Council (GCC) members follow suit? For now, the Strategy stake is a calculated toe-dip — symbolic, but influential.

Bitcoin in the Gulf: Saudi Arabia Leads the Region’s Crypto Momentum

Saudi Arabia’s interest in Bitcoin comes at a time when the Middle East is experiencing a surge in digital asset engagement. According to Bitget Research, the region surpassed 500,000 daily cryptocurrency traders by February 2024 — with Saudi Arabia accounting for over 129,000 at its peak, surpassing even the UAE. That figure represents not just retail curiosity but a broader appetite for blockchain innovation and digital finance across the Kingdom.

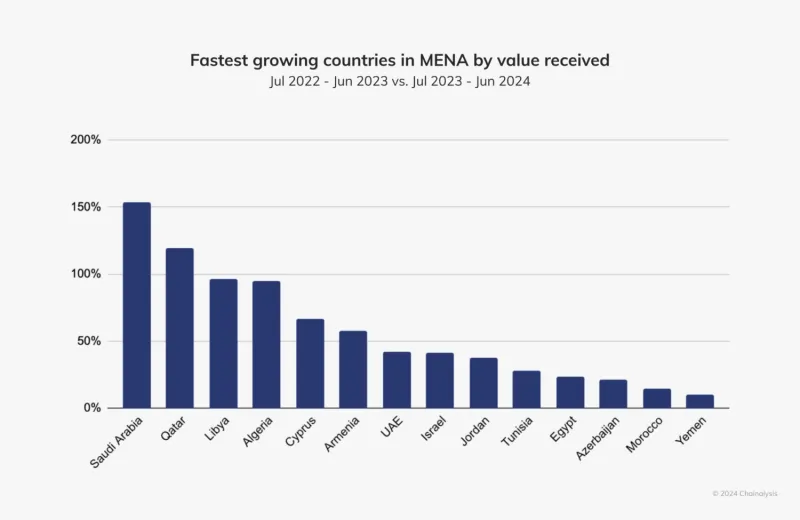

Data from Chainalysis’ 2024 MENA report underscores this momentum. Saudi Arabia’s crypto economy has grown by 154% year-over-year for two consecutive years, marking it as the fastest-growing market in the Middle East and North Africa. This growth is being fueled by multiple sectors — from central bank digital currency (CBDC) exploration and fintech development to gaming and digital identity tools integrated with blockchain infrastructure.

Importantly, this explosion in activity has not yet been matched with a coherent regulatory framework. Saudi Arabia does not currently regulate domestic cryptocurrency exchanges, and there is no legal structure that recognizes or defines crypto assets as securities, commodities, or currencies. This regulatory vacuum presents both a risk and an opportunity for innovators — and makes the central bank’s Bitcoin-linked investment even more remarkable.

Vision 2030 and Blockchain Innovation

Saudi Arabia’s Vision 2030 plan emphasizes diversification, digital transformation, and investment in emerging technology sectors. Blockchain fits naturally into this blueprint. Whether through tokenized securities, decentralized logistics, or financial inclusion, blockchain promises applications that align with national priorities. The country’s youth-driven population — over 65% of Saudis are under 30 — further supports this shift. With high digital literacy and rapid tech adoption, Saudi society is primed to embrace decentralized systems, particularly in consumer finance and payments.

𝗥𝗼𝘁𝗵𝘀𝗰𝗵𝗶𝗹𝗱 𝗠𝗮𝗸𝗲𝘀 𝗮 𝗠𝗮𝗷𝗼𝗿 𝗘𝗻𝘁𝗿𝘆 𝗜𝗻𝘁𝗼 𝗦𝗮𝘂𝗱𝗶 𝗔𝗿𝗮𝗯𝗶𝗮

With news of Saudi Arabia abandoning the petrodollar and rumored to be interested in joining BRICS, Edmond de Rothschild Bank is partnering with SNB Capital, Saudi Arabia’s largest asset… pic.twitter.com/OBjilUAK3v

— Shadow of Ezra (@ShadowofEzra) June 14, 2024

That environment may explain why the Saudi Central Bank opted for equity exposure in a crypto-heavy firm — it signals strategic alignment with innovation trends while retaining institutional distance from crypto’s legal ambiguities. In essence, it’s a way of saying “yes” to Bitcoin, without committing to custody or direct trading.

🇸🇦 Saudi Arabia: 34.4M people, $1.14T GDP, 92% urban, and a young population driving crypto growth.

Vision 2030 is fueling adoption, KSA is primed to be a Web3 powerhouse.

With a median age of 29, this crowd is young, wired, and vibing with the #CHILLGUY 🥶🚶♂️🍀#Crypto… pic.twitter.com/gQesQgn62H

— 𝘽𝙖𝙡𝙙𝙧 (@Raptorj69) May 14, 2025